- Home

- Success stories

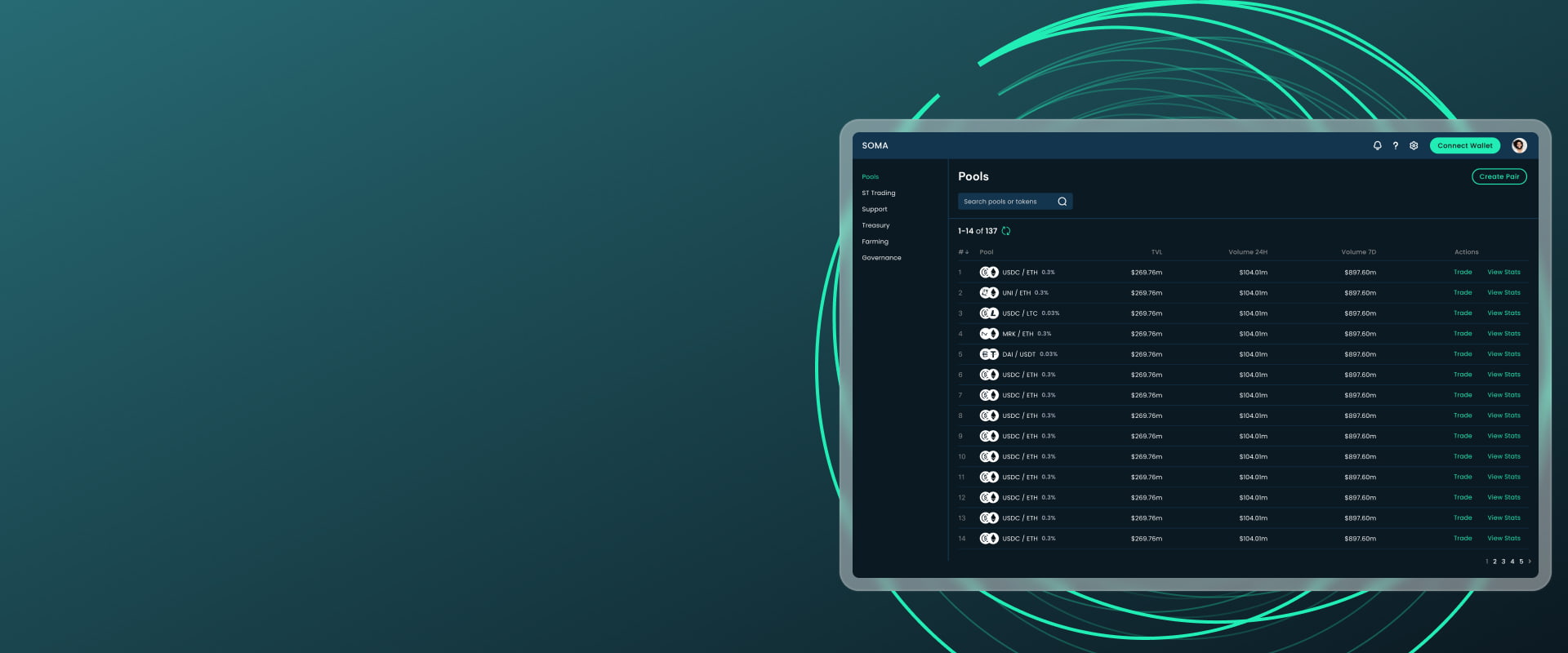

- SOMA DEX

About the client

Mantra DAO is a community-governed multi-blockchain DeFi platform that focuses on staking, lending, and governance and has a daily trading volume of $4 million. The project advocates for financial transparency and strives to give financial control back to the people.Details

- Website:app.mantradao.com

- Location:Hong Kong

- Date:2020

Business opportunity

- Having examined the DeFi market, the client realized that it lacks a globally compliant P2P marketplace that would accommodate various crypto assets such as security tokens, utility tokens, and non-fungible tokens.

- That’s how Mantra DAO landed on the idea to build SOMA — a platform that will allow people form different financial backgrounds to earn revenue avoiding market manipulations and restrictive authorities. All SOMA users will have the opportunity to participate in liquidity pools, airdrops, burns and buybacks, and yield farming.

- To bring their ground-breaking idea to life the client reached out to us. PixelPlex and Mantra DAO share a successful partnership experience, so the client entrusted us to assist them with the new project’s viability evaluation and preparation of a vision and scope document.

Project goals

The client prioritized the following goals:

- 1

Establish a blockchain-based multi-asset platform that will allow users to work with standard LP tokens and participate in STO trading

- 2

Maintain KYC & AML/KYT system to ensure greater transparency and prevent malicious users from entering the site

- 3

Enable whitelisting of wallets and securities so that no third party can withdraw funds

- 4

Create a native utility token compliant under Reg D, Reg A+, and Reg S offerings

- 5

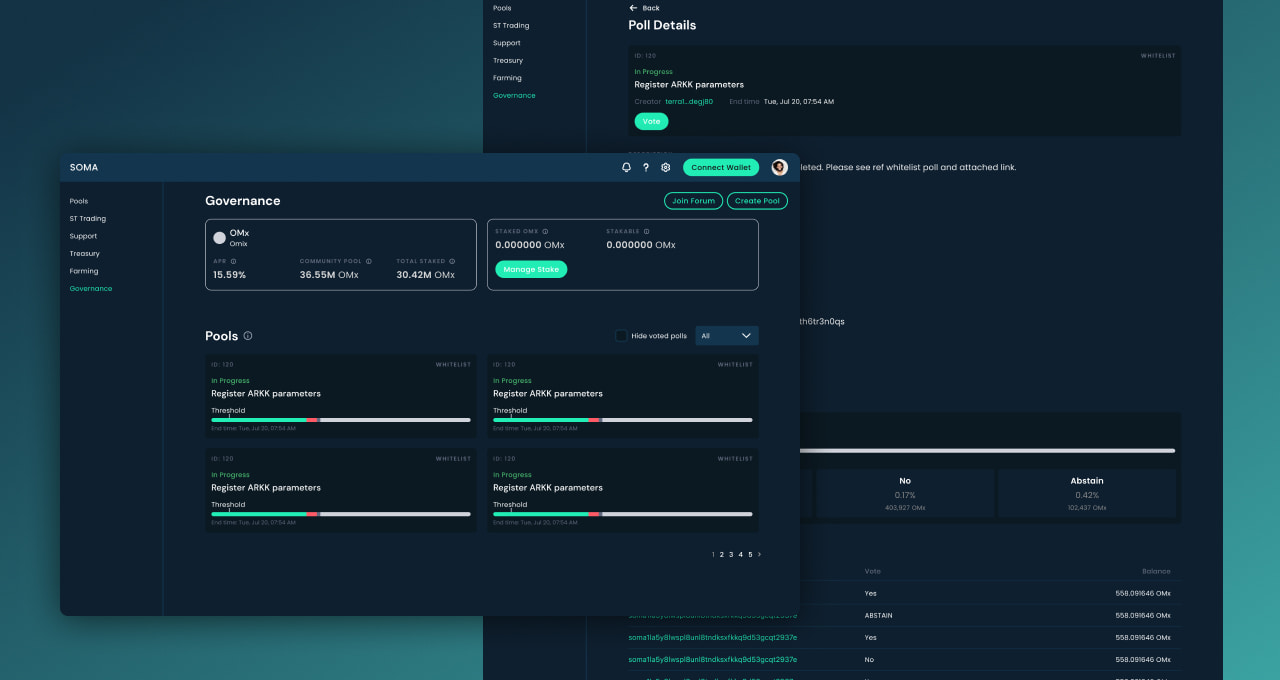

Introduce community voting to better identify the most popular assets

Work done

Our consulting team conducted an in-depth industry analysis, evaluated the feasibility of the client’s idea, and determined technical stack and product architecture. All these aspects were presented to the client as a thorough vision and scope document so that it can later be used as a precise roadmap and a solid demo for investors.

Project features

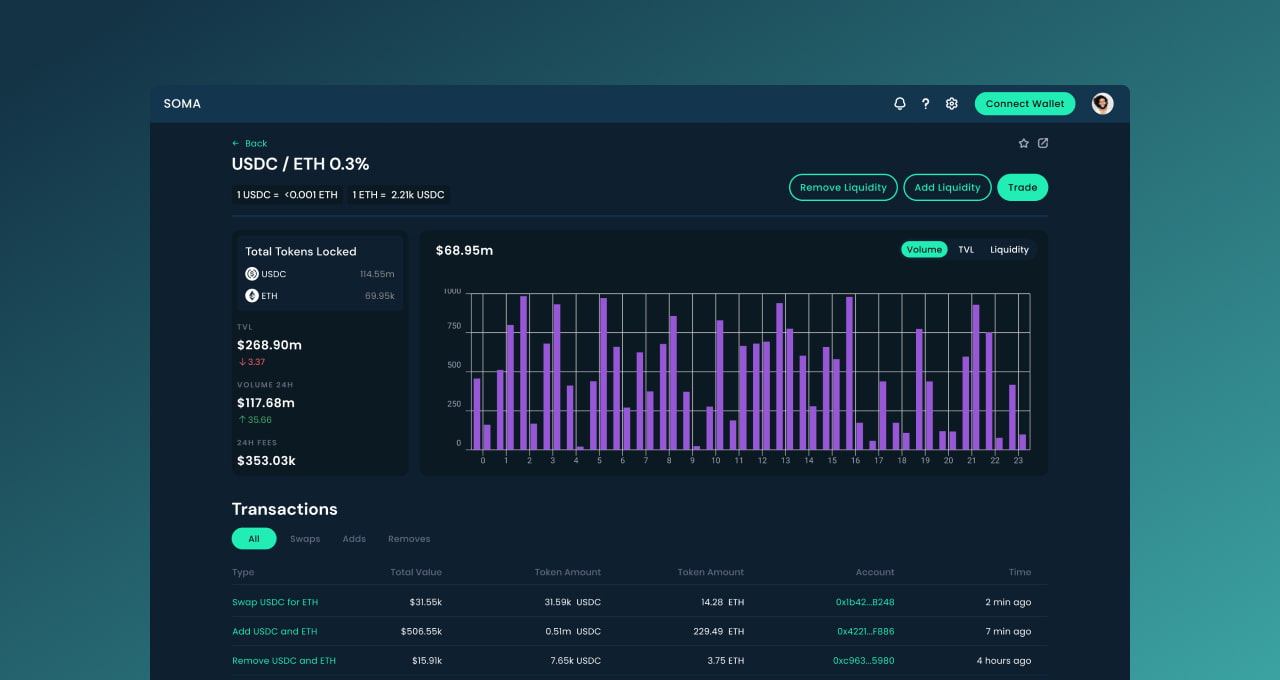

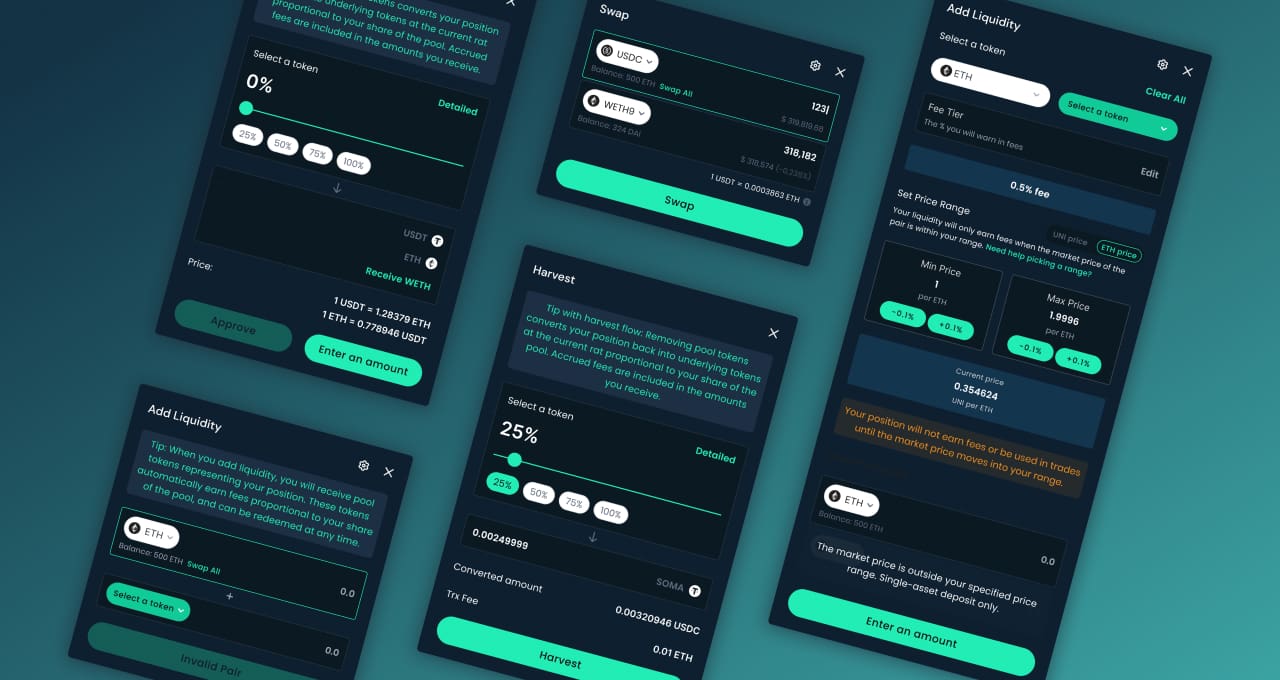

Multi-asset trading

Native $SOMA utility token

International regulations compliance

High-level security measures such as KYC, AML and KYT

Permissionless regulated AMM

24/7 trading

Why wait to put your game-changing blockchainproject into action ?

Details

* The design of layouts was provided by the client.

Solution components

Our consultants performed a discovery session which helped them identify the necessary platform’s functionality. Together with the client, we determined the core solution components:

- Personal account page featuring the account statistics

- Wallet page with the information about the wallet address and balance

- Governance page featuring a list of all active pools and their statistics

- NFT marketplace allowing users to add, create, sell, buy, hold and edit NFTs

User roles

Having evaluated the platform’s functionality and the client’s requirements, we specified 6 user roles:

Admin

Manages the pools, monitors their statistics and transaction history, and is in charge of verifying new users

LP trader

Participates in swapping and farming in different liquidity pools to earn revenue

ST trader

Participates in swapping and farming in different security token liquidity pools to earn revenue

LP broker

Creates new liquidity pools, utility and stablecoin tokens and removes LP pools if they are not active. LP brokers receive tokens as a fee for each swap in their LP pool

ST broker

Creates new security token liquidity pools and removes them if no there is no activity. ST brokers farm liquidity from STLP and receive fee percentage for each swap

Guest

Can access the platform in read mode only and is able to connect the wallet and go through the KYC procedures

User flow and processes

Our team highlighted the core points of user flow on the platform:

- 1

To register on the platform each users goes through KYC and AML checks

- 2

To engage in the platform's activities users need to connect their crypto wallets

- 3

Users can create liquidity and farming pools for stablecoins, utility and security tokens, and add/remove liquidity

- 4

Each user can participate in voting to influence the platform’s activities and community

Technologies and tools

Smart contracts

We identified smart contacts that SOMA will leverage for many of its operations, with the core contracts being:

Governance / Polling

Sets polling logic and methods to manage and interact with community voting

DEX

A Uniswap’s fork, modified to meet the requirements of the SOMA system

Controller

Is responsible role-based access control mechanism and tokens whitelisting

Treasury Storage

Accumulates and stores parts of DEX commissions and sets logic of their interaction

Mixed Bag

Sets logic of synthetic token for multiple tokens

Got an idea? Let’s work together

Native $SOMA token

While managing a wide variety of crypto assets, the platform will possess its native token — $SOMA. It will grant users the right to participate in the platform’s governance and will be Reg D, Reg A+, and Reg S compliant.

Third-party integrations

To ensure that all processes are perfectly smooth and reliable, PixelPlex suggested the client to integrate the following third-party tools and solutions:

- We recommended the client leverage Hex Trust as it is one of the leading digital asset custodians, safeguarding $5 billion assets from 200 institutional clients. Besides, Hex Trust already successfully ensures tamper-proof functioning of the Mantra DAO platform.

- For greater user convenience we suggested integration of several crypto wallets: Metamask, Walletconnect, WalletLink, and Coinbase Wallet as they have proved themselves to be the most reliable and efficient.

- To protect the users’ wallets from any fraudulent activity, we highlighted the need to maintain wallet whitelisting. Our team suggested CipherTrace or Chain Analysis as they are the top-notch cryptocurrency intelligence companies.

Results

With the development and implementation strategy provided by PixelPlex, the client has completed a $6.5 million seed round managing to attract interest of the global DeFi community. The project has successfully entered the development phase, following the specifications given in the vision and scope document.

* The design of layouts was provided by the client.

Services

We offer a comprehensive range of services, including IT consulting, custom software development, and specialized expertise in blockchain, machine learning, and data science.

Blockchain Development

Blockchain Development

Smart Contract Development

Web3 Development

Blockchain Game Development

Crypto Payment Solutions

Tokenization Services

Protocols

Protocols

Cryptocurrency Exchange Development

Cryptocurrency Development

Marketplace Development

Dapp Development

DeFi Development

Top Development Company

Blockchain Consulting

Smart Contract Audit

Top Blockchain Consulting Company

Custom Software Development

Custom Software Development

Mobile App Development

Web Development

Top IT Services Company

IT Consulting

Top Consulting Company

ML Development

Artificial Intelligence Development

Machine Learning Development

Data Science Development

Top BI & Big Data Company

AR & VR Development

AR & VR Development

QA & Software Testing

QA & Software Testing Services

UI/UX DesignGive us the pleasure of adding our secret sauce to your app.

We’ll create beautiful screens at the front while breaking the limits of what’s behind them to help your app get to beyond-plausible business achievements.

UI/UX Design Services

MVP DevelopmentValidate your product idea quickly with an MVP—launch faster, test smarter, and refine based on real user feedback.

Leverage our expertise in MVP development to build a scalable, market-ready product with minimal risk and maximum efficiency.

MVP Development Services

Metaverse Consulting & Development

Top Development Company

Solutions

RWA PlatformTokenization makes it easier to trade assets and opens up new investment opportunities and diversifies portfolio.

RWA Platform

Asset tokenization platform development

Arbitrage BotProfit from market inefficiencies with automated, customized trading strategies that boost returns and minimize risk.

Arbitrage Bot

Be a transaction ahead. Catch profit at short notice

CryptoAPIGain an unfair data edge for your dApps. Tap into high-quality blockchain insights to outsmart competitors and fuel smarter decisions.

CryptoAPI

Connect your dApps to blockchain networks in a flash

OTC HawkOffer high-net-worth clients a secure, enterprise-grade trading terminal. Streamline deals, enhance reliability, and optimize top-tier crypto assets.

OTC Hawk

Benefit from our portfolio and wealth management app

DocFlowManage sensitive documents on blockchain. Leverage optional zero-knowledge proofs for trust, privacy, and streamlined workflows.

DocFlow

Intuitive Blockchain-Powered Document Management System

Know-Your-TransactionEnsure every transaction is above board. Monitor digital asset flows for compliance and transparency, supporting both businesses and regulators.

KYT crypto platform

Our KYT platform fosters integrity of financial ecosystems

Industries

We work across a variety of industries, from FinTech to eCommerce, leveraging our accumulated knowledge and best practices to deliver solutions tailored to the unique needs of your business.

FinTech & BankingAs traditional finance goes digital, we are committed to building efficient ecosystems and better engagement.

Think of customized FinTech solutions with tamper-proof transactions and storage, progress transparency and automation — and we’ll make them see the light of day.

$25T

Global Financial Services

20%

Digital/Blockchain Growth

Solutions for FinTech & Banking

PaymentWe build secure and seamless payment software solutions that increase revenue, reduce friction, and scale with your business.

If you're integrating payments into your platform and need a team with deep financial technology expertise, we'll help you engineer transactions with precision and reliability.

$9.5T

Global Digital Commerce Value

30%

Growth in Embedded Finance

Payment

Retail & eCommerceWhether you market B2B or B2C, commerce tech trends are all about value-driven purposes, global sustainability, hybrid shopping journeys, and extra-resiliency.

Let your clients know that there’s more to your brand than meets the eye by creating unique customer experiences in all your stores.

$6.3T

Global eCommerce

10-15%

Tech Innovation Growth

Solutions for Retail & eCommerce

Supply Chain & LogisticsTo make things easier for all vendors, we deliver apps for route and cost optimization, vehicle operational support, and better dispatch time efficiency.

With focus is sustainability, resilience, transparency, and immutability, let’s get your transformation going.

$10T

Global Logistics

15-20%

Blockchain Adoption Growth

Solutions for Supply Chain & Logistics

HealthcareCustom healthcare software solutions are aimed at helping you ensure accurate diagnosis, better patient engagement, and positive healthcare outcomes.

Whether you require a patient management solution, practice management software, EMR/EHR system, or ML-enabled diagnostics – we’ve got you covered.

$10T

Global Healthcare

20%

Digital/Blockchain Growth

Solutions for Healthcare

Real EstateKeep up with digital innovation trends by accelerating enterprise transformation and scaling, leveraging data and orchestrating workflows.

Whether you manage and sell commercial facilities or invest third-party capital, our integrated solutions help you make the most of it.

$340T

Global Real Estate

15%

PropTech/Blockchain Growth

Solutions for Real Estate

Oil & GasWith mobility and digital technologies standing to change the game and define leadership, our mission is to get you digital-first.

Resolve operational and conceptual issues by introducing clear tech vision, feasible architectures, and flexible software to take business extension off limits.

$4T

Global Oil & Gas Industry

10-15%

Digital/Blockchain Growth

Solutions for Oil & Gas Industry

InsuranceImagine a world where quoting policies, processing claims, and managing mountains of paperwork are effortless. PixelPlex can help you achieve just that.

Break free from outdated systems and focus on what truly matters – delivering exceptional service to your policyholders and growing your insurance business.

$25T

Global financial services

20%

Digital/blockchain growth

Solutions for Insurance Industry

FitnessWe create custom fitness software solutions that support meaningful training and steady engagement from the first session.

If you’re building a digital product for active users and need a team with real project experience behind it, we’ll help you bring it to life with clarity and purpose.

$257B

Global Fitness Industry

24%

Digital Growth

Solutions for Fitness

BankingFinancial systems face continuous change and ongoing scrutiny throughout their lifecycle as products evolve.

Our solutions are designed to stay predictable under regulatory oversight and daily operational load, helping teams build systems they can rely on.

$191T

Global Bank Assets

62%

Digital Payments Use

Solutions for Banking

RestaurantCustom restaurant management software allows for reducing costs, smooth internal CRM and delivery systems integration, and easy scalability.

We develop restaurant ecosystems that turn your complex business data into actionable insights that the whole team can understand and use.

$4.2T

Global Food Service Market Value

+7.2%

Annual Growth Rate

Solutions for Restaurant

TravelCustom software development for travel helps agencies to get rid of fragmented operations and make decisions based on data, and with an aim of future growth.

We offer travel software solution development services that transform internal operational data into clear, actionable insights that the whole team can use.

$9.5T

Global Travel & Tourism Market Value

+5.8%

Annual Growth Rate

Solutions for Travel

Success stories

Domain

Industry

Protocols

Company

About us Team Careers Social Responsibility ContactsBlog

Blockchain Big Data Artificial Intelligence AR/VR Mobile News View Blog