- Home

- Success stories

- Mantra DAO

About the client

Our client, Mantra DAO, is developing a community-governed DeFi platform aimed at giving financial control back to users through a transparent and decentralized ecosystem. The platform is focused on lending, staking, governance, and launchpad services.Details

- Website:app.mantradao.com

- Location:Hong Kong

- Date:2021

Business opportunity

Initially, the client brought in a third-party service provider to assist them with the development of their DeFi platform. However, the resulting platform had inefficiencies such as bugs in existing smart contracts that needed to be fixed.

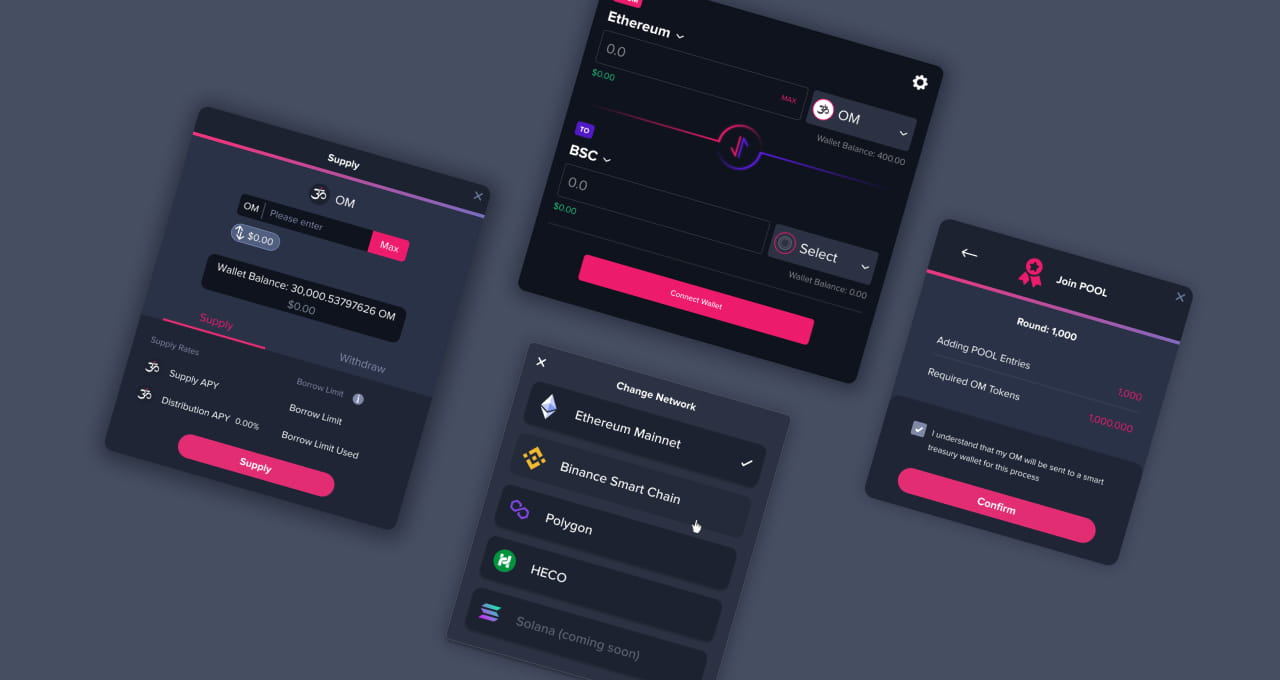

Aiming to continually improve the platform, the client wanted to enhance it with new functionality by implementing new smart contracts and adding new platforms, including Binance Smart Chain and Polygon (being built as a Polkadot-first project, the platform only supported Ethereum when the customer approached PixelPlex). These changes would allow Mantra DAO to offer services on different blockchains.

The client chose PixelPlex to complement their in-house team and join their project as a trustworthy technology services provider with extensive experience in blockchain and smart contracts development.

Project goals

Together with the client, we established the key project goals:

- 1

Improve the performance of the Mantra DAO platform and eliminate inefficiencies

- 2

Add new smart contracts and staking pools

- 3

Incorporate multi-chain support

- 4

Add new functionality to the existing platform

Work done

Development of smart contracts

Deployment of new staking pools

Migration from staking pool V1 to staking pool V2

Extension of the existing functionality to new platforms (Binance Smart Chain, Polygon)

Bug fixes, UI enhancements, and inefficiencies resolution

Project features

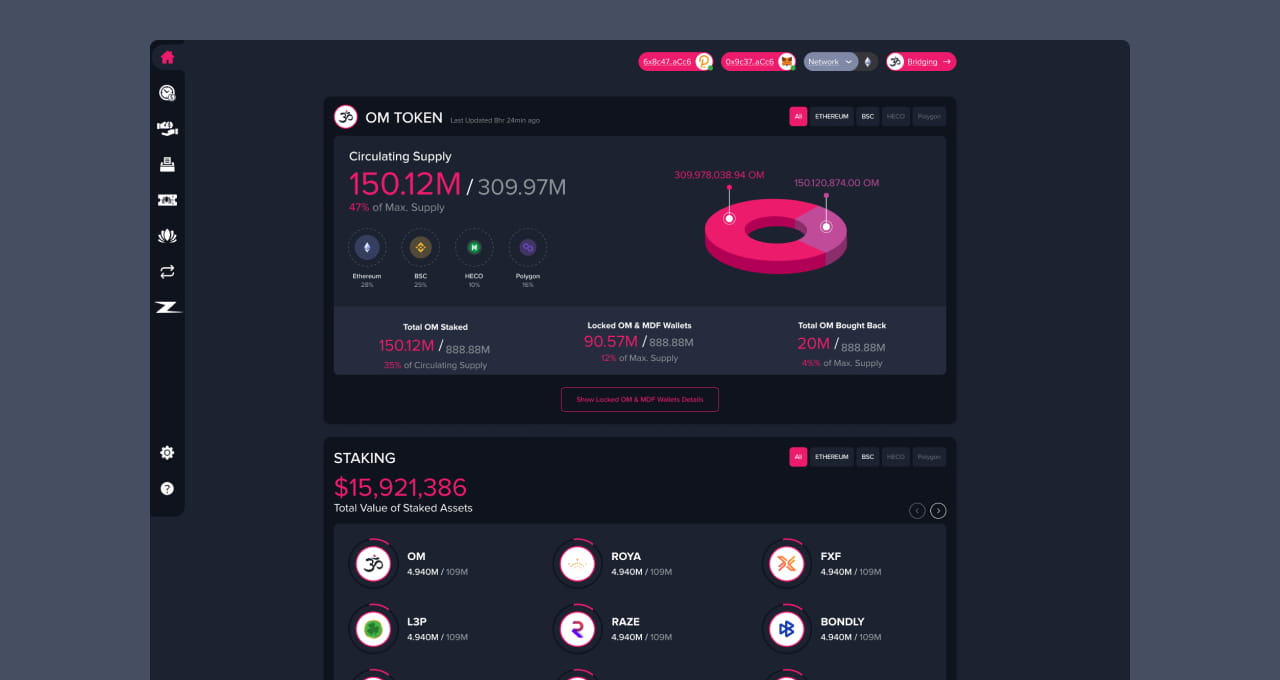

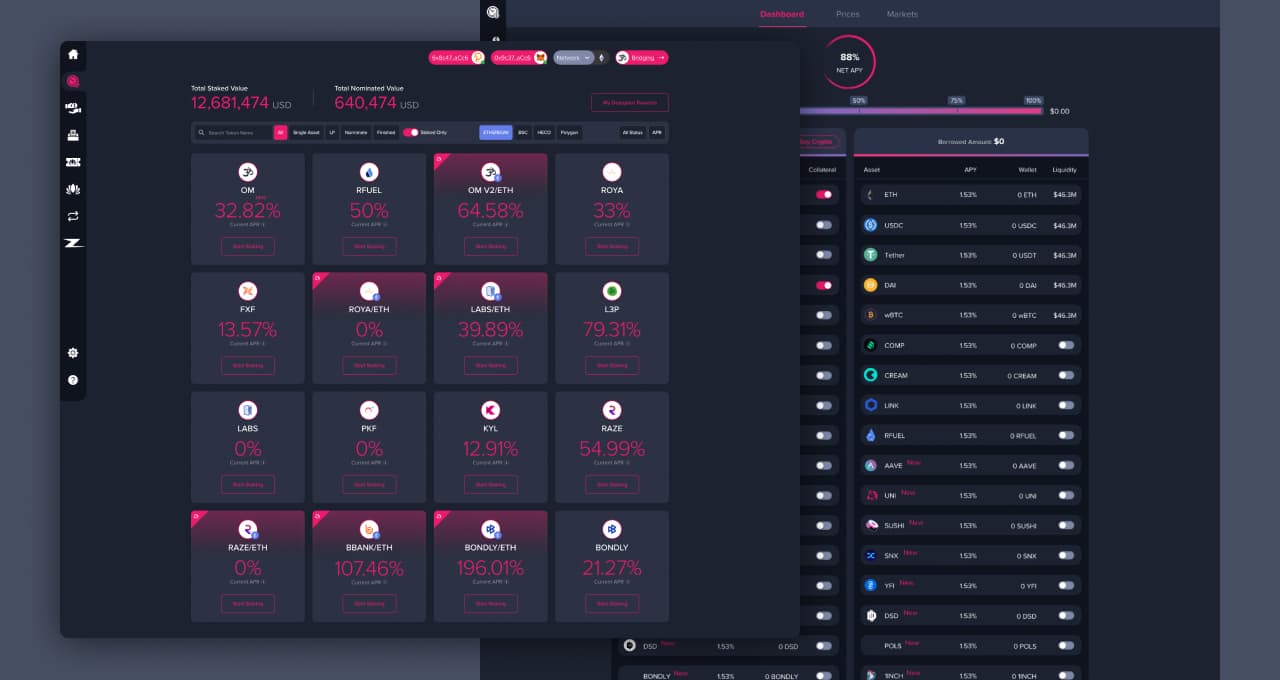

Multi-chain support, including Ethereum, Binance Smart Chain and Polygon

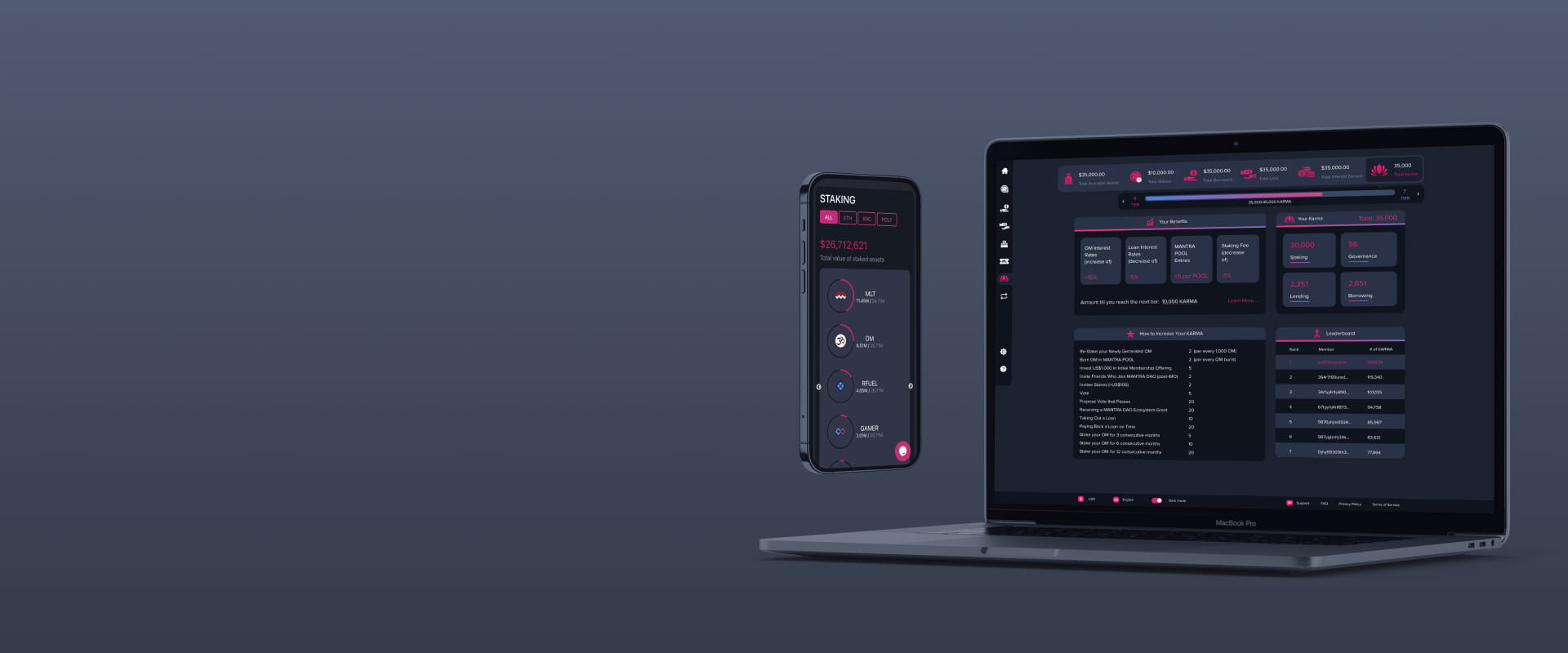

Multiple staking pools on different networks

The ability to manage assets staking and governance in one place

The platform’s own token – OM token

Secure smart contracts for staking pools

Zendit launchpad solution offering all the necessary tools and resources for organizations to launch their tokens

Details

* The design of layouts was provided by the client.

One of the largest of Mantra DAO’s modules is Staking, which allows users to stake tokens and receive token rewards. The company offers both single asset and LP staking pools. The client had already developed staking smart contracts when we joined the project, but they had bugs that could lead to potential security issues in the production environment.

To prevent security problems, our team resolved the bugs in the LP staking smart contract and followed up with unit tests. We also developed a smart contract for single asset staking from scratch. The logic we introduced makes it easy to roll out new staking pools.

Staking pools deployment

Mantra DAO regularly partners with different organizations and adds further new tokens to staking pools. For each partnership our specialists deploy new staking pools based on the parameters provided by the customer (for example, token owner or token rewards).

To begin with, our team implemented new staking pools on the Ethereum network. In order to offer a chain-agnostic solution, the client extended their staking to Binance Smart Chain and Polygon, so our team is now also responsible for deploying new staking pools for these platforms.

Throughout the project we deployed 60+ staking pools on different networks (Ethereum, Binance Smart Chain, Polygon).

Security audit

Focusing on enhanced security, the customer approached SlowMist – a company engaged in blockchain ecological security – to perform security audits of smart contracts developed by our team. After a detailed analysis and testing, our smart contracts successfully passed the audit with no major issues found.

PixelPlex assisted the client with the development of Zendit launchpad. It uses a decentralized fixed swapping protocol which provides transparency with regard to the number of tokens offered during a token launch. Zendit offers the client’s partner organizations the necessary resources and support to launch their tokens.

Dutch Auction mechanism

The distinctive feature of the implemented launchpad is that it offers the opportunity to use a Dutch Auction style of launch in addition to standard fixed swap protocols. The major benefit of the Dutch Auction mechanism lies in it being a decentralized and democratic way of determining the price of a company’s coin, where bidding for an item begins with a high asking amount which is systematically lowered until a user makes the winning bid and the item is sold.

PixelPlex assisted the client in implementing the logic for migration from staking pool V1 to staking pool V2 and token swap to OM V2.

OM V2 is an enhanced version of the OM token, which has many important advantages, including but not limited to:

- auto-compounded staking rewards

- immediate unstaking for a fee

- the ability to cancel unstaking and automatically re-stake

- improved countdown timer (seconds, minutes, hours, days).

Thanks to the implemented logic, Mantra DAO end users can migrate to a new version in only a few clicks and start staking OM V2 tokens.

Development of a migration mechanism

The major problem was that the first version of the staking pool developed by the client didn’t have migration functionality. It was essential that users’ existing assets could be seamlessly migrated to staking pool V2 so that users who had tokens in staking pool V1 could easily receive rewards in the new staking pool.

Our team conducted technical research to make the required migration possible. We made changes to the existing architecture of the solution and implemented a migration mechanism. As a result, the platform’s users were able to easily move to staking pool V2 without losing their existing tokens and rewards.

Got an idea? Let’s work together

Moving from Ethereum to Solana

Benefits of using Solana

The use of PoS consensus algorithm

Frequent transactions (more than 65,000 per second)

Better scalability

Lower transaction cost ($0,00025)

Prepared research

Our blockchain consultants prepared research, which covered multiple aspects and the various peculiarities of the Solana blockchain. It included details such as a high-level overview of the platform, the ownership of accounts, a guide on how to create a coin in Solana, and returning values from cross-program invocations.

When the final decision to move to Solana was made, the client asked our team to choose the optimal migration strategy and then proceed with the chosen variant. PixelPlex tech specialists researched different migration options, evaluating the pros and cons of each scenario.

Choosing the best migration strategy

1st strategy

Use Neon virtual machine to run Solidity contracts directly in Solana

- Dependency on the Neon project

- This approach offers less flexibility due to the dependency on a third-party tool

- A simple solution as it may not require writing any code

- Neon is very immature, which results in bugs and limitations (e.g. we faced many issues trying to deploy a simple Ethereum contract)

- It is a whole new ecosystem with its own coins (which are now sold to private investors)

- It can only be used for Solana

2nd strategy

Rewrite everything in Rust

- There is no dependency on any project

- Better overall flexibility

- It will take more time compared to using a virtual machine, yet the performance can be tuned to fit the client’s need

- The maintenance burden

3rd strategy

Compile Solidity contracts into Solana’s blockchain using Solang

- Compile Solidity contracts into Solana’s blockchain using Solang

- Better flexibility as some of the contracts may be rewritten completely while others will be recompiled by Solidity compiler

- A simple solution as there is no need to completely rewrite all the contracts

- Solidity contracts must be tuned to circumvent restrictions of Solang

- Assembly language can't be compiled (but it is used in the MANTRA Dao stake contracts)

- Sizes of integers must not be higher than 64 bit (whereas they are bigger in the project)

- Need to write code in order to trigger these smart contracts, which will add to the maintenance burden

Initially, we considered taking advantage of the Solang compiler due to its flexibility and time-efficiency. However, after reviewing the limitations associated with Solang, we decided to go with rewriting everything in Rust. This approach allowed us to achieve increased flexibility and performance. Currently our team is in the process of migrating to the Solana blockchain.

Results

60+

staking pools deployed

$23M

total value of stacked assets (as of April 2022)

Services

We offer a comprehensive range of services, including IT consulting, custom software development, and specialized expertise in blockchain, machine learning, and data science.

Blockchain Development

Blockchain Development

Smart Contract Development

Web3 Development

Blockchain Game Development

Crypto Payment Solutions

Tokenization Services

Protocols

Protocols

Cryptocurrency Exchange Development

Cryptocurrency Development

Marketplace Development

Dapp Development

DeFi Development

Top Development Company

Blockchain Consulting

Smart Contract Audit

Top Blockchain Consulting Company

Custom Software Development

Custom Software Development

Mobile App Development

Web Development

Top IT Services Company

IT Consulting

Top Consulting Company

ML Development

Artificial Intelligence Development

Machine Learning Development

Data Science Development

Top BI & Big Data Company

AR & VR Development

AR & VR Development

QA & Software TestingQA & Software Testing Services

UI/UX DesignGive us the pleasure of adding our secret sauce to your app.

We’ll create beautiful screens at the front while breaking the limits of what’s behind them to help your app get to beyond-plausible business achievements.

UI/UX Design Services

MVP DevelopmentValidate your product idea quickly with an MVP—launch faster, test smarter, and refine based on real user feedback.

Leverage our expertise in MVP development to build a scalable, market-ready product with minimal risk and maximum efficiency.

MVP Development Services

Metaverse Consulting & DevelopmentValidate your immersive concept quickly with metaverse development — launch your virtual experience, gather actionable user insights on core features like avatars and social interaction, and iterate based on real-world engagement.

Top Development Company

Solutions

RWA PlatformTokenization makes it easier to trade assets and opens up new investment opportunities and diversifies portfolio.

RWA Platform

Asset tokenization platform development

Arbitrage BotProfit from market inefficiencies with automated, customized trading strategies that boost returns and minimize risk.

Arbitrage Bot

Be a transaction ahead. Catch profit at short notice

CryptoAPIGain an unfair data edge for your dApps. Tap into high-quality blockchain insights to outsmart competitors and fuel smarter decisions.

CryptoAPI

Connect your dApps to blockchain networks in a flash

OTC HawkOffer high-net-worth clients a secure, enterprise-grade trading terminal. Streamline deals, enhance reliability, and optimize top-tier crypto assets.

OTC Hawk

Benefit from our portfolio and wealth management app

DocFlowManage sensitive documents on blockchain. Leverage optional zero-knowledge proofs for trust, privacy, and streamlined workflows.

DocFlow

Intuitive Blockchain-Powered Document Management System

Know-Your-TransactionEnsure every transaction is above board. Monitor digital asset flows for compliance and transparency, supporting both businesses and regulators.

KYT crypto platform

Our KYT platform fosters integrity of financial ecosystems

Industries

We work across a variety of industries, from FinTech to eCommerce, leveraging our accumulated knowledge and best practices to deliver solutions tailored to the unique needs of your business.

FinTech & BankingAs traditional finance goes digital, we are committed to building efficient ecosystems and better engagement.

Think of customized FinTech solutions with tamper-proof transactions and storage, progress transparency and automation — and we’ll make them see the light of day.

$25T

Global Financial Services

20%

Digital/Blockchain Growth

Solutions for FinTech & Banking

PaymentWe build secure and seamless payment software solutions that increase revenue, reduce friction, and scale with your business.

If you're integrating payments into your platform and need a team with deep financial technology expertise, we'll help you engineer transactions with precision and reliability.

$9.5T

Global Digital Commerce Value

30%

Growth in Embedded Finance

Payment

Retail & eCommerceWhether you market B2B or B2C, commerce tech trends are all about value-driven purposes, global sustainability, hybrid shopping journeys, and extra-resiliency.

Let your clients know that there’s more to your brand than meets the eye by creating unique customer experiences in all your stores.

$6.3T

Global eCommerce

10-15%

Tech Innovation Growth

Solutions for Retail & eCommerce

Supply Chain & LogisticsTo make things easier for all vendors, we deliver apps for route and cost optimization, vehicle operational support, and better dispatch time efficiency.

With focus is sustainability, resilience, transparency, and immutability, let’s get your transformation going.

$10T

Global Logistics

15-20%

Blockchain Adoption Growth

Solutions for Supply Chain & Logistics

HealthcareCustom healthcare software solutions are aimed at helping you ensure accurate diagnosis, better patient engagement, and positive healthcare outcomes.

Whether you require a patient management solution, practice management software, EMR/EHR system, or ML-enabled diagnostics – we’ve got you covered.

$10T

Global Healthcare

20%

Digital/Blockchain Growth

Solutions for Healthcare

Real EstateKeep up with digital innovation trends by accelerating enterprise transformation and scaling, leveraging data and orchestrating workflows.

Whether you manage and sell commercial facilities or invest third-party capital, our integrated solutions help you make the most of it.

$340T

Global Real Estate

15%

PropTech/Blockchain Growth

Solutions for Real Estate

Oil & GasWith mobility and digital technologies standing to change the game and define leadership, our mission is to get you digital-first.

Resolve operational and conceptual issues by introducing clear tech vision, feasible architectures, and flexible software to take business extension off limits.

$4T

Global Oil & Gas Industry

10-15%

Digital/Blockchain Growth

Solutions for Oil & Gas Industry

InsuranceImagine a world where quoting policies, processing claims, and managing mountains of paperwork are effortless. PixelPlex can help you achieve just that.

Break free from outdated systems and focus on what truly matters – delivering exceptional service to your policyholders and growing your insurance business.

$25T

Global financial services

20%

Digital/blockchain growth

Solutions for Insurance Industry

FitnessWe create custom fitness software solutions that support meaningful training and steady engagement from the first session.

If you’re building a digital product for active users and need a team with real project experience behind it, we’ll help you bring it to life with clarity and purpose.

$257B

Global Fitness Industry

24%

Digital Growth

Solutions for Fitness

BankingFinancial systems face continuous change and ongoing scrutiny throughout their lifecycle as products evolve.

Our solutions are designed to stay predictable under regulatory oversight and daily operational load, helping teams build systems they can rely on.

$191T

Global Bank Assets

62%

Digital Payments Use

Solutions for Banking

RestaurantCustom restaurant management software allows for reducing costs, smooth internal CRM and delivery systems integration, and easy scalability.

We develop restaurant ecosystems that turn your complex business data into actionable insights that the whole team can understand and use.

$4.2T

Global Food Service Market Value

+7.2%

Annual Growth Rate

Solutions for Restaurant

TravelCustom software development for travel helps agencies to get rid of fragmented operations and make decisions based on data, and with an aim of future growth.

We offer travel software solution development services that transform internal operational data into clear, actionable insights that the whole team can use.

$9.5T

Global Travel & Tourism Market Value

+5.8%

Annual Growth Rate

Solutions for Travel

Success stories

Domain

Industry

Protocols

Company

About us Team Careers Social Responsibility ContactsBlog

Blockchain Big Data Artificial Intelligence AR/VR Mobile News View Blog