Alfprotocol

Solana-based yield farming and liquidity protocol with enhanced leverage and farming rewards

- Blockchain

- Web

- Smart Contracts

- DeFi

- Yield Farming

- Blockchain

- Web

- Smart Contracts

- DeFi

- Yield Farming

- Home

- Success stories

- Alfprotocol

About the client

The client, Alfprotocol, is an ambitious technology-driven startup aiming to build a liquidity provision protocol as a step toward third-generation DeFi.Details

- Location:Lithuania

- Date:2022

The PixelPlex team delivered the Alfprotocol — an efficient, decentralized application for liquidity provision and yield farming. It allows users to borrow funds by offering collateral and supply tokens to pools, thus earning yield and token rewards for being liquidity providers.

Team

Backend developer

3Frontend developer

2UI/UX designer

QA specialist

Project manager

Business analyst

Business opportunity

Aware of the flaws of centralized exchanges such as hacks, scams, and market manipulation, the client has been closely watching innovations introduced by the Decentralized Finance (DeFi) market. Among the innovations are automated market makers (AMMs) that facilitate the decentralized exchange of digital assets by using liquidity pools.

But the DeFi community hasn’t stopped there. The second generation of DeFi introduced token incentives for liquidity provision (yield farming), margin trading and leveraged positions.

In the light of all these advances, the startup decided to edge towards the third generation of DeFi and build their own solution that would offer leverage for liquidity providers in AMMs.

That’s how the startup came up with the Alfprotocol.

Project goals

Having come up with their idea the startup approached PixelPlex as a reliable blockchain development vendor to take care of the solution development.

Together, we worked out the following goals:

- 1

Implement the core protocol for leveraged liquidity provision in AMMs

- 2

Implement a protocol for lending and overcollateralized borrowing

- 3

Provide traders and investors of various risk appetites with a platform that facilitates liquidity flows and maximizes capital efficiency

Work done

- A set of smart contracts on the Solana blockchain

- A protocol for leveraged liquidity provision and yield farming

- A protocol for overcollateralized borrows

- Frontend app and SDK for interacting with Alfprotocol

- Quality assurance tests

Solution

Our team helped the customer build the Alfprotocol — a Solana-based protocol for liquidity provision and yield farming. The protocol allows users to participate in isolated pools as lenders and borrowers and provides for enhanced leverage and farming rewards with up to a 200x liquidity margin.

The solution comprises several key products, including:

Project features at a glance

- Leveraged yield farming and liquidity provision with margin of up to 200x

- Incentivized liquidity pools with and without leverage

- Single-asset liquidity pools for lenders and overcollateralized debt positions for borrowers

- Intuitive UI/UX which ensures seamless user experience

- Liquidation bot that ensures the highest leveraged yield farming positions

Got an idea? We’re ready to discuss it

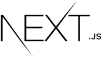

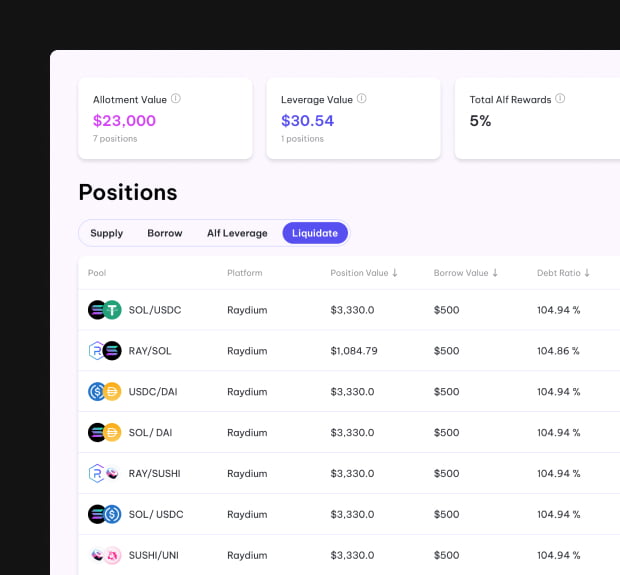

Alf Leverage

Alf Leverage provides a smooth leveraged yield farming experience for users with superior rewards. To implement it, our team integrated Alf Leverage with the Raydium protocol and ensured their interoperability.

When interacting with the protocol, traders can choose from different liquidity pools and enter positions by supplying their assets as collateral. They can increase their position size when investing in liquidity provision. Traders can also remove their position at any time by withdrawing the collateral or closing the entire position.

The mechanism as a whole proceeds as follows:

- The user sees the list of available positions

- The user borrows external liquidity

- The user adds their liquidity to yield farm

- Having more liquidity in their yield farm, the user gains more rewards

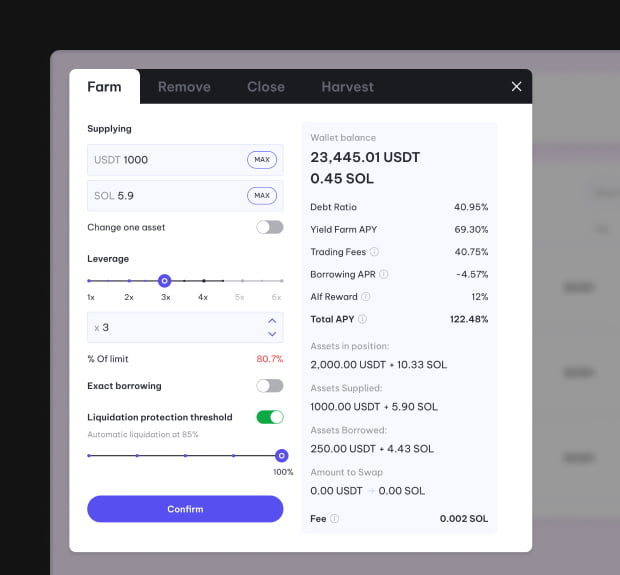

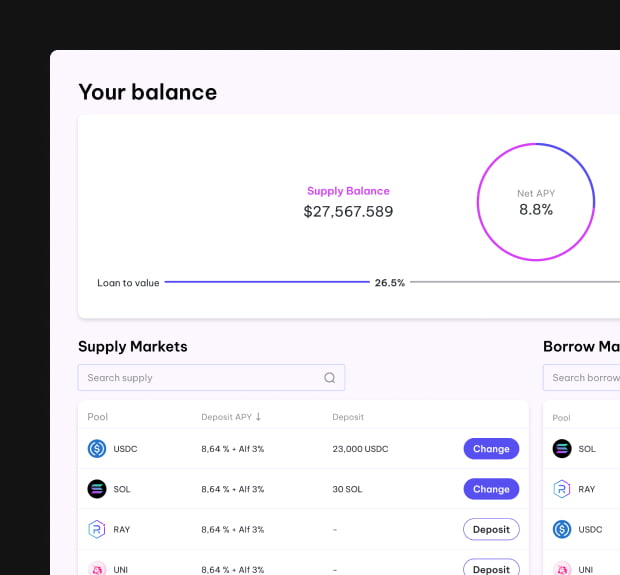

Allotment Alf

Our team helped the customer implement Allotment Alf — a protocol for lending and overcollateralized borrowing. The protocol uses single-asset liquidity pools for lenders and overcollateralized debt positions for borrowers.

Allotment Alf allows users to deposit their assets and earn an annual percentage yield on top. Alternatively, users can borrow against their deposited assets or leverage borrowed capital anywhere in Web3.

Treasury

Our team implemented a Treasury smart contract — a solution for connecting lending and borrowing protocols. The unique feature of the protocol is that it provides for routing liquidity between multiple protocols, thereby allowing Alf Leverage to use funds from Allotment Alf or any other lending protocol.

Treasury is responsible for all financial flows on the platform. It aggregates data about current loan conditions, enables borrowing, tracks position health, and keeps collaterals in its custody.

Liquidation bot

To ensure the highest leveraged yield farming positions in the Solana ecosystem, we implemented the liquidation bot run by the Allotment Alf team. The task of the bot is to ensure that underwater positions are liquidated, thus protecting lenders from loss.

Also, to mitigate risks for the platform, we’ve implemented partial liquidations. This means that the bot will not liquidate the entire position but only a specific part of it. For example, suppose a trader has a debt of $140 and collateral worth $150. To cover the debt, the bot can partially liquidate this position by selling $130 of the user’s collateral. As a result, the trader will have $10 debt and $20 collateral left.

Have a new project in mind?

Technologies & tools

Solana-based protocol

Together with the client, we opted for the Solana blockchain as the basis of the project for the following reasons:

- 1

Fast transactions and low fees. Solana can handle up to 65,000 tps versus Ethereum’s 13-15 tps.

- 2

A large and well-developed ecosystem with multiple projects built on top of the platform.

- 3

A lot of institutional attention with more and more developers moving to this blockchain.

Modular approach

The protocol consists of two major components:

- A set of smart contracts on the Solana blockchain

- Frontend application that interacts with smart contracts

We built the Alfprotocol using a modular approach to ensure the solution's scalability. As a result, we can expand the protocol’s functionality and add new modules without having to redeploy existing contracts.

One of the key modules of the platform is the Treasury module, which contains the logic for the borrowing and lending protocols, such as how to spend the borrowed funds. To take Allotment Alf as an example, the protocol will send the borrowed funds to the user’s wallet while Alf Leverage will use them for staking on Raydium.

To track utilization rates, we used Price Oracles — a set of programs that enable the retrieval of price information for a given asset.

Results

up to200x

yield farming and liquidity provision

892K

initial market cap (as of Aug 2022)

months6

time taken to develop the solution

Services

We offer a comprehensive range of services, including IT consulting, custom software development, and specialized expertise in blockchain, machine learning, and data science.

Blockchain Development

Web3 Development

Crypto Payment Solutions

Tokenization Services

Protocols

Protocols

Cryptocurrency Exchange Development

Top Development Company

Blockchain Consulting

Top Blockchain Consulting Company

Custom Software Development

Mobile App Development

Web Development

Top IT Services Company

IT Consulting

Top Consulting Company

ML Development

Machine Learning Development

Data Science Development

Top BI & Big Data Company

AR & VR Development

AR & VR Development

UI/UX DesignGive us the pleasure of adding our secret sauce to your app.

We’ll create beautiful screens at the front while breaking the limits of what’s behind them to help your app get to beyond-plausible business achievements.

UI/UX Design Services

QA & Software TestingEngage us for integrated quality assurance services, and our experts will advise on QA strategy and optimize software testing costs.

We’ll balance manual testing with QA automation to ensure consistent performance for all possible use cases and devices.

QA & Software Testing Services

MVP DevelopmentValidate your product idea quickly with an MVP—launch faster, test smarter, and refine based on real user feedback.

Leverage our expertise in MVP development to build a scalable, market-ready product with minimal risk and maximum efficiency.

MVP Development Services

Solutions

Arbitrage BotProfit from market inefficiencies with automated, customized trading strategies that boost returns and minimize risk.

Arbitrage Bot

Be a transaction ahead. Catch profit at short notice

CryptoAPIGain an unfair data edge for your dApps. Tap into high-quality blockchain insights to outsmart competitors and fuel smarter decisions.

CryptoAPI

Connect your dApps to blockchain networks in a flash

OTC HawkOffer high-net-worth clients a secure, enterprise-grade trading terminal. Streamline deals, enhance reliability, and optimize top-tier crypto assets.

OTC Hawk

Benefit from our portfolio and wealth management app

DocFlowManage sensitive documents on blockchain. Leverage optional zero-knowledge proofs for trust, privacy, and streamlined workflows.

DocFlow

Intuitive Blockchain-Powered Document Management System

Know-Your-TransactionEnsure every transaction is above board. Monitor digital asset flows for compliance and transparency, supporting both businesses and regulators.

KYT crypto platform

Our KYT platform fosters integrity of financial ecosystems

Industries

We work across a variety of industries, from FinTech to eCommerce, leveraging our accumulated knowledge and best practices to deliver solutions tailored to the unique needs of your business.

FinTech & BankingAs traditional finance goes digital, we are committed to building efficient ecosystems and better engagement.

Think of customized FinTech solutions with tamper-proof transactions and storage, progress transparency and automation — and we’ll make them see the light of day.

$25T

Global Financial Services

20%

Digital/Blockchain Growth

Solutions for FinTech & Banking

Retail & eCommerceWhether you market B2B or B2C, commerce tech trends are all about value-driven purposes, global sustainability, hybrid shopping journeys, and extra-resiliency.

Let your clients know that there’s more to your brand than meets the eye by creating unique customer experiences in all your stores.

$6.3T

Global eCommerce

10-15%

Tech Innovation Growth

Solutions for Retail & eCommerce

Supply Chain & LogisticsTo make things easier for all vendors, we deliver apps for route and cost optimization, vehicle operational support, and better dispatch time efficiency.

With focus is sustainability, resilience, transparency, and immutability, let’s get your transformation going.

$10T

Global Logistics

15-20%

Blockchain Adoption Growth

Solutions for Supply Chain & Logistics

HealthcareCustom healthcare software solutions are aimed at helping you ensure accurate diagnosis, better patient engagement, and positive healthcare outcomes.

Whether you require a patient management solution, practice management software, EMR/EHR system, or ML-enabled diagnostics – we’ve got you covered.

$10T

Global Healthcare

20%

Digital/Blockchain Growth

Solutions for Healthcare

Real EstateKeep up with digital innovation trends by accelerating enterprise transformation and scaling, leveraging data and orchestrating workflows.

Whether you manage and sell commercial facilities or invest third-party capital, our integrated solutions help you make the most of it.

$340T

Global Real Estate

15%

PropTech/Blockchain Growth

Solutions for Real Estate

Oil & GasWith mobility and digital technologies standing to change the game and define leadership, our mission is to get you digital-first.

Resolve operational and conceptual issues by introducing clear tech vision, feasible architectures, and flexible software to take business extension off limits.

$4T

Global Oil & Gas Industry

10-15%

Digital/Blockchain Growth

Solutions for Oil & Gas Industry

InsuranceImagine a world where quoting policies, processing claims, and managing mountains of paperwork are effortless. PixelPlex can help you achieve just that.

Break free from outdated systems and focus on what truly matters – delivering exceptional service to your policyholders and growing your insurance business.

$25T

Global financial services

20%

Digital/blockchain growth

Solutions for Insurance Industry

Success stories

Domain

Industry

Protocols

Company

About us Team Careers Social Responsibility ContactsBlog

Blockchain Big Data Artificial Intelligence AR/VR Insights News View Blog